- The Two Global Economic Giants US & China Give 90 Days Relief to Global Markets

- Commodity Prices Remain Under Pressure Amid Concerns Over Lower Global Economic Growth

- Steel Prices Under Pressure On Rising Supply & Expectations of Lower Demand

- For Base Metals, LME Cancelled Warrants Ratio Shows No Sign of Pick in Demand

- Copper & Nickel Prices are Trading Lower to Range Bound, Waiting for Some Positive News

- Weakness in Oil, is Positive for Businesses and Consumers

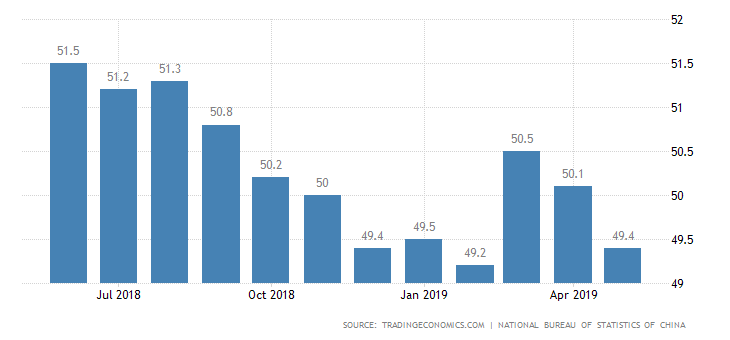

Overall business sentiment has been adversely impacted, on account of continued uncertainty over rising protectionism and trade war between the two global economic giants. Over the years, the global economy has become interdependent, and if one sneezes the effect of the same is likely to be on the global economy. Amid growing trade tensions and rising protectionism, businesses across the globe have expressed concerns and remain cautious over major expansion plans, which could lead to slower global economic growth.

On the economic front, the US economy remains on a firm footing while China and many other economies have seen slower economic growth in recent months. In our opinion, weak commodity prices, especially oil is positive for businesses and consumers, as input cost pressures would remain lower and inflation would remain contained. But the most important event today is “discussions between US and China trade representatives” and a resolution on the trade conflict is of utmost important for the global economy on a whole.

There have been many ups and downs in the commodity markets largely due to tit-for-tat tariffs imposed by the world’s top two economies, China and the US. The ongoing U.S.-China trade wars have weighed heavily on prices of copper, nickel and steel prices.

In this article, we look into price movement in some important commodities:

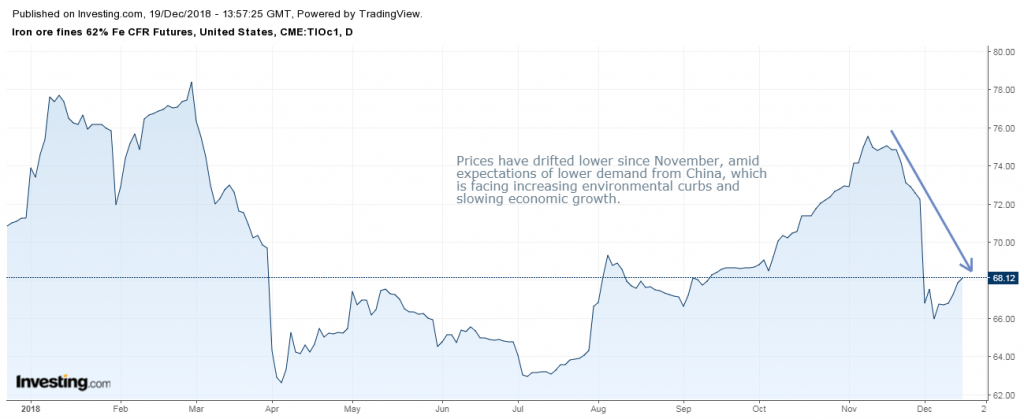

Iron Ore Fines 62% Fe CFR Futures (TSI), CME

Iron Ore Prices CFR Futures China

An important steel making raw material and a barometer of the global economic health, Iron Ore prices have remained mixed in the past few months, due to lower steel prices. Steel prices have declined in China amid rising steel output, and concerns over lower manufacturing growth in China. Steel prices (China Rebar Futures) peaked in August 2018, and later fell owing to concerns over trade dispute with the US. Over the same time, supplies with Chinese mills increased which has adversely impacted the market sentiment and kept traders away from adding inventories.

Iron ore prices have drifted lower since November, amid expectations of lower demand from China, which is facing increasing environmental curbs and slowing economic growth. Iron Ore Fines 62% Fe CFR Futures (TSI, CME) have declined by around 12% to reach a low of $66 on 5th December 2018. Iron ore price have since recovered and stood at $68.12, as on 13th December 2018.

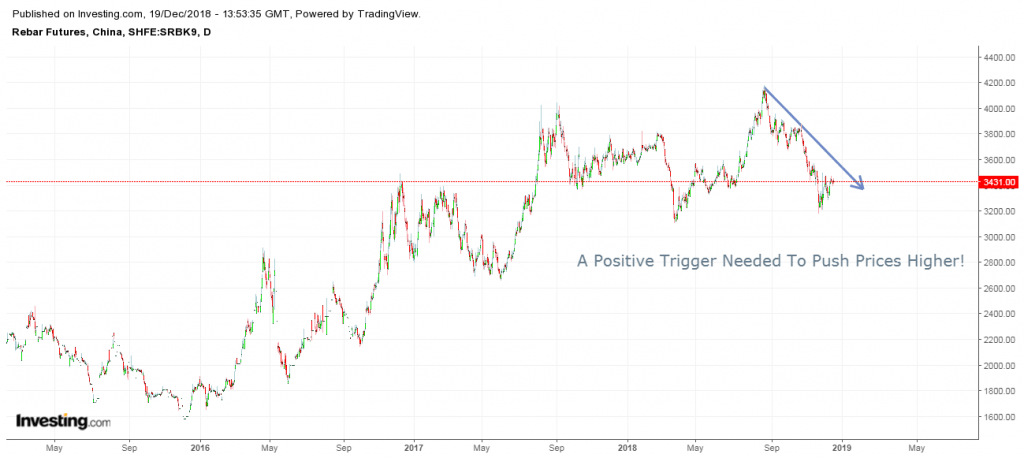

Rising Supply & Growth Concerns Hit Chinese & Global Steel Prices

China Steel Rebar Futures, SHFE

China Steel Rebar Future Prices, Steel Prices in China 19thDecember2018

China steel rebar prices have remained weak, on account of rising steel supplies in China, slowing economic growth and falling infrastructure investment. Chinese economic growth has slowed to 6.5% (YOY) in the third quarter of 2018, its weakest pace since 2009, due to growing global protectionism and trade conflict with the US. The growth rate is down from 6.8% and 6.7% in the first and second quarters of 2018, respectively, but in line with a Chinese government growth target of around 6.5% for the whole year.

Prices for China Steel Rebar Futures, SHFE fell from a peak of 4178 yuan per ton on 21st August 2018, to a low of 3179 yuan per ton on 26th November 2018, marking a decline of around 23%. At 3431 yuan per ton, steel rebar prices have recovered 8% from the lows on expectations that soon there will be a resolution between US and China with respect to trade restrictions. The steel market sentiment still remains weak in China and globally, and the current rise could be attributed to re-stocking by traders in China, who are looking to benefit from lower steel prices.

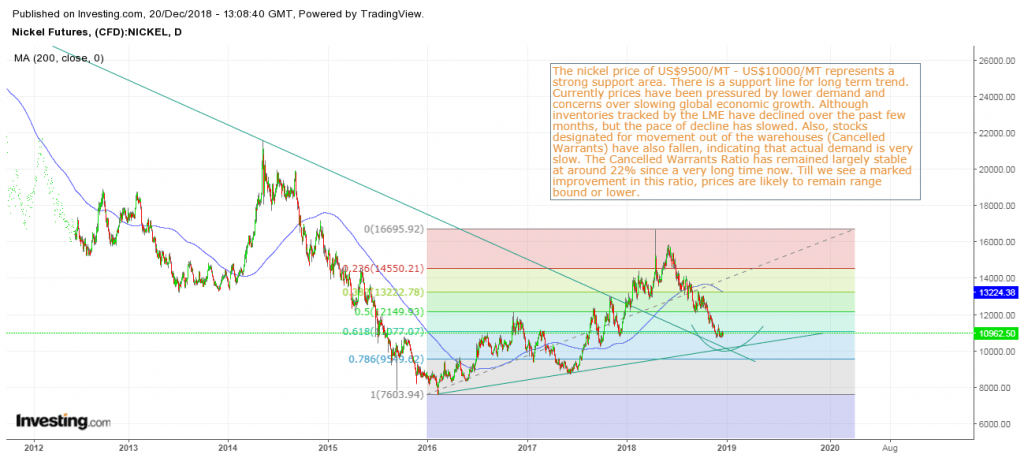

LME Nickel Prices under Pressure, On Rising Supplies from Indonesia and China Growth Concerns

Nickel Prices 18 December 2018

The nickel price of US$9500/MT – US$10000/MT represents a strong support area. There is a long term trend line support from two previous lows, while the long term downward trend line was also broken. Currently prices have been pressured by lower demand and concerns over slowing global economic growth. Although inventories tracked by the LME have declined over the past few months, but the pace of decline has slowed. Also, stocks designated for movement out of the warehouses (Cancelled Warrants) have also fallen, indicating that actual demand is very slow. The Cancelled warrants ratio has remained largely stable at around 22% since a very long time now. Till we see a marked improvement in this ratio, prices are likely to remain range bound or lower. There are also many people in the industry who believe that LME numbers are manipulated, but sometimes it is a good indicator for taking big purchase decisions. All this while since the last year, with the EV vehicle demand buzz, the cancelled warrant ratio has not shown positive signs, making us believe that nickel supply remains sufficient, as of now. The cancelled warrant ratio for LME Nickel, stood at 22% on 18th December 2018, down from 33% on 15 December last year.

We can expect some short term bounce backs, on some positive news, but the key trigger would be resolution of trade issues between US & China, followed by rising demand from electric vehicle battery or component manufacturers. We remain positive on nickel prices in the long term, and wait for more positive signs from the demand side.

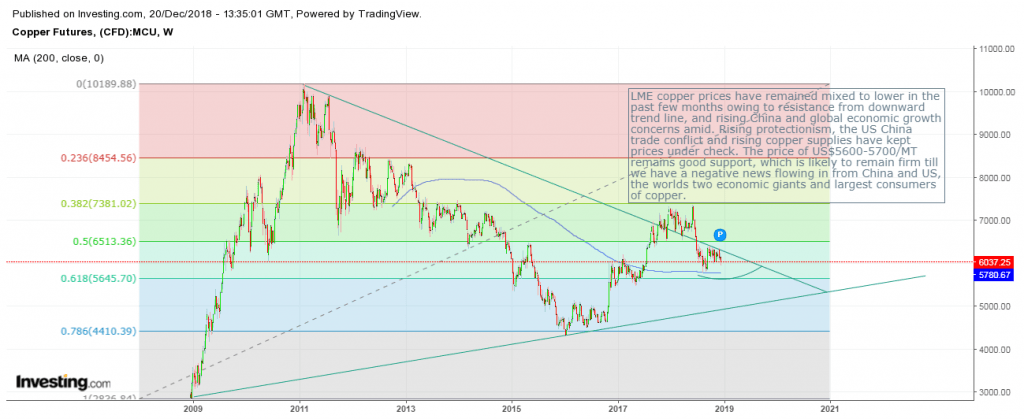

Copper Prices Remain Pressured on Weak Demand & Concerns Over Chinese and Global Economic Growth

Copper Prices Analysis 20 December 2018LME copper prices have remained mixed to lower in the past few months owing to resistance from downward trend line, and rising China and global economic growth concerns amid. Rising protectionism, the US China trade conflict and rising copper supplies have kept prices under check. The price of US$5600-5700/MT remains good support, which is likely to remain firm till we have a negative news flowing in from China and US, the world’s two economic giants and largest consumers of copper.

The Author – Metline Industries is a leading manufacturer and processor of aluminium, nickel, titanium and stainless steel alloys in various forms including pipes, plates, fittings, flanges, and relate piping accessories. We are India’s leading steel pipes supplier and steel plates suppliers, with exports to over 50 countries worldwide. Our key products include stainless steel plates, stainless steel sheets, aluminium plates, aluminium sheets, stainless steel coils, stainless steel pipes, stainless steel pipe fittings, stainless steel round bars, stainless steel angles, flexible hose pipes, ss flexible hose pipes and stainless steel flanges. We are India’s leading manufacturer of pipes fittings with exports to the US, Europe, Saudi Arabia, Qatar, Kuwait, and various other Middle East Nations.

Leave A Comment