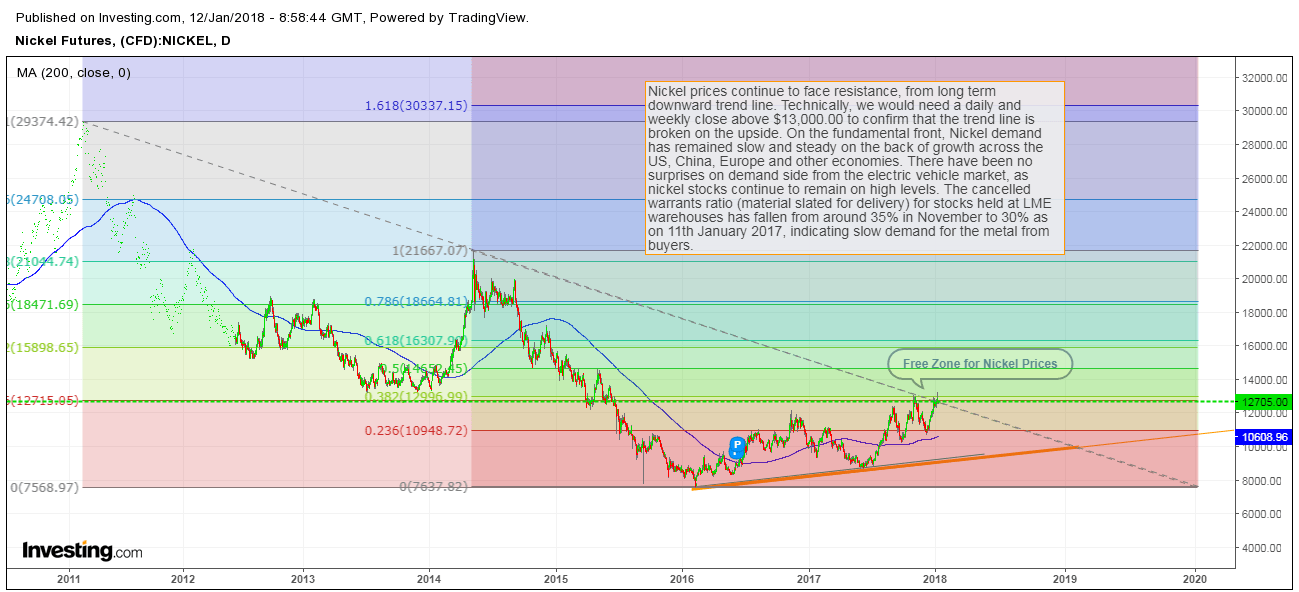

Nickel prices continue to face resistance, from long term downward trend line. Technically, we would need a daily and weekly close above $13,000.00 to confirm that the trend line is broken on the upside. On the fundamental front, Nickel demand has remained slow and steady on the back of growth across the US, China, Europe and other economies. The demand for nickel from the stainless steel market continues to remain stable, while there have been no major surprises on demand side from the electric vehicle market, as nickel stocks continue to remain at elevated levels. The cancelled warrants ratio (material slated for delivery) for stocks held at LME warehouses has fallen from around 35% in November to 30% as on 11th January 2018, indicating slow demand for the metal from buyers.

The Cancelled Warrants Ratio For Other Base Metals, at LME Warehoses

LME Copper – The cancelled warrants ratio for copper is down from 35% on 10th November 2017 to 23.6% as on 11th January 2018. The ratio is up from 16.4% on 15th December to current level of 35%, while 3M future prices have moved up by 3.3% during this period to $7130/MT on the LME.

LME Nickel – The cancelled warrants ratio for nickel is down from 35% on 10th November to 30.3% as on 11th January 2018. The ratio is down from 33.6% on 15th December to current level of 30.3%, while prices are up by 9.8% to $12,700/MT on the LME.

LME Zinc – The cancelled warrants ratio for Zinc is down from 31% on 10th November 2017 to 30% as on 11th January 2018. The ratio is up from 15% on 15th December to current level of 30.3%, while 3M future prices have moved up by 5.9% during this period to $3394/MT on the LME.

LME Aluminium – The cancelled warrants ratio for Aluminium has remained unchanged at 22% between 10th November 2017 to 11th January 2018. The ratio is up from 20% on 15th December to current level of 22%, while 3M future prices have moved up by 6.3% during this period to $2201/MT on the LME.

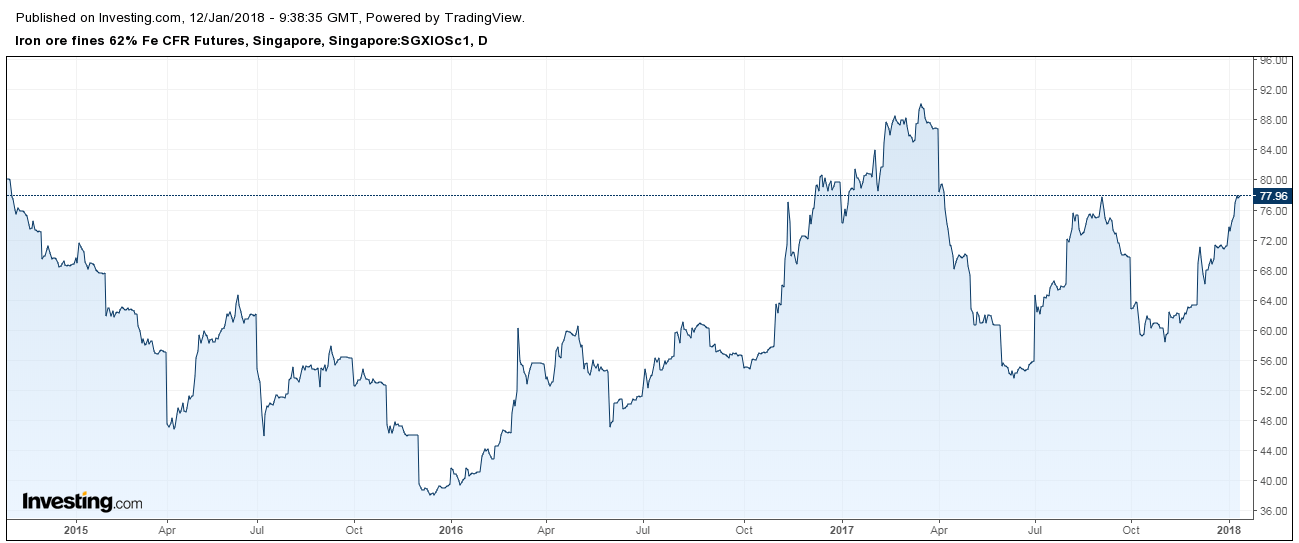

Steel Prices Have Increased Across the Board, On Account of Rise in Raw Material Prices

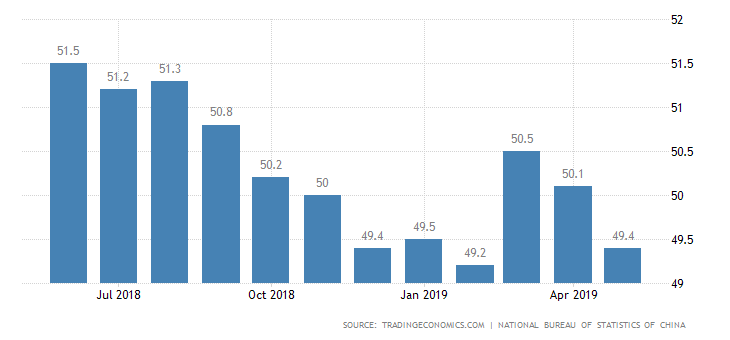

The steel manufacturing companies are witnessing uptrend in other costs of raw materials such as iron order, coke, coal, refractory and electrodes. Customers are finding it difficult to absorb a sudden increase in steel prices by mills across the globe, as a result of which buying activity has slowed down at the distributors and service center levels. An increase in all major input raw materials has put pressure on steel companies to pass on the increased cost of production to their customers.

In addition to increase in raw material prices, steel prices have also been supported by market expectations that China will act to restrict new steel production capacity to be built. According to Reuters, China’s Industry and Information Technology Ministry said it would allow one tonne of new capacity to be built for each 1.25 tonnes closed in key regions in the period ahead, an outcome that acted to support steel prices in the later parts of the session.

Iron Ore Prices, Updated as on 11th January 2017

Metline Industries is a leading manufacturer and processor of aluminium, nickel, titanium and stainless steel alloys in various forms including pipes, plates, fittings, flanges, and relate piping accessories. We are India’s leading steel pipes supplier and steel plates suppliers, with exports to over 50 countries worldwide. Our key products include stainless steel plates, stainless steel sheets, stainless steel coils, aluminium plates, aluminium sheets, stainless steel pipes, stainless steel pipe fittings, stainless steel round bars, stainless steel angles, stainless steel rods, flexible hose pipes, ss flexible hose pipes and stainless steel flanges. We are India’s leading manufacturer of pipes fittings, with exports to the US, Europe, Saudi Arabia, Qatar, Kuwait, and various other Middle East Nations.